Construction

It is the purchase of an ITM put and the simultaneous writing of an OTM put, with the same expiration on the same underline security.

It is a debit spread because the money we have to pay for the long put is more than the money we earn from the written put.

When to use

When we believe that the price of the underline security will fall but not very much. In order to take advantage of the decline, we write the OTM put and we use the proceeds from the sale to partially finance the purchase of the long put. The expected decline should be mild because the put bear spread strategy imposes a limit on potential profits. Maximum loss occurs when the price of the underline closes at or above the higher strike price at expiration and maximum profit when it closes at or below the lower strike.

Loss/Profit at expiration

Maximum loss: Net premium paid + commissions.

Maximum profit: (Long put strike – short put strike) – net premium paid – commissions.

Profit/Loss diagram

Below we can see the profit/loss diagram for the put bear spread strategy. We assume that the long put has strike $30 and premium $3 and the short put has strike $25 and premium $1.

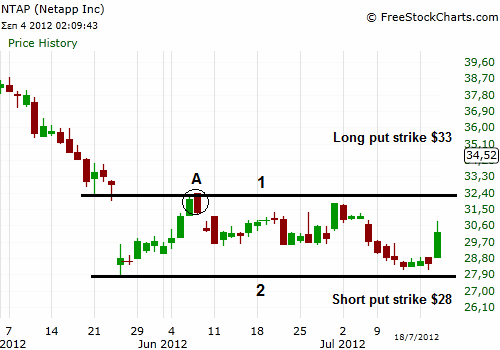

Put bear spread strategy example

In the daily chart of NTAP price is visiting a strong resistance (line 1) for the first time, so the possibility of a reversal is high. The market (SPY) at the same time is in a mid term uptrend and that’s why we believe that the price of the stock will not decline very much for the next month. Also near $28 we can spot a support (line 2) which will possibly prevent a farther downward movement. At the end of the day in point A, we can observe a dark cloud cover candlestick pattern which augments the possibility of a reversal.

We can buy 5 puts with strike $33, premium $2.50 and expiration after one month and write 5 puts with strike $28, premium $0.50 and the same expiration. If the stock after one month is at $28 or below, then we achieve the maximum profit which is $1500 minus commissions {[($33-$28)-($2.50-0.50)]x500}. If the stock at expiration is at or above $33, both puts are worthless (OTM) and we have the maximum loss which is $1000 plus commissions [($2.50-$0.50)x500]. Of course we can close any leg or the whole position before expiration if we find it useful.

En

En Gr

Gr