A simple trading strategy doesn’t mean an unreliable strategy, on the contrary. Success in trading lies on a set of simple rules that have to be followed strictly. By rules we basically mean technical analysis and risk management rules.

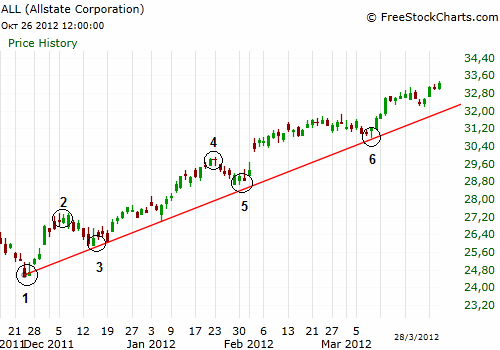

A very simple trend following strategy which works in all time frames (day & swing trading) is to open long positions when the price of a financial instrument (currency pair, stock, future, etc.) is visiting a clear trend-line after a correction, just like the daily chart of stock ALL below in which we have a clear uptrend and a clear trend line.

Notice that trends are not always accompanied by a clear trend line and in that case we cannot apply the strategy.

In the above chart first we have to spot the trend by defining two consecutive higher lows and higher highs (points 1, 2, 3, 4) and then entering long at points 5 or 6.

The stop loss order should be placed below the trend line and the profit target should be above the previous high (based on the assumption that the price will continue up trending).

Additionally, in a downtrend we should open a short position after defining two consecutive lower highs and lower lows, like in the 5 minutes chart of PKI below.

We can spot the downtrend by using points 1, 2, 3, 4 and we can open short positions at points 5, 6. The stop loss will be above the trend-line and the profit target below the lower low (based on the assumption that the price will continue down trending).

Of course just like in every trading strategy don’t always expect to be correct, mostly at the times that the trend is about to reverse. Also very tight stops might close the position prematurely although the price could still move as anticipated.

Last and more important we are actively managing the trade and changing the stop order if the price is moving in our favor in order to ensure profits.

En

En Gr

Gr